As we incubate new lines of business for large organizations, many of the new ventures are enabled by AI. German energy giant RWE, for example, created SF-based Pear.ai, a virtual energy assistant with a clever AI chatbot named Sam. While some companies embrace AI into their core processes products, many prefer to make their first venture into AI through small incubations.

There’s a good reason everyone is rushing to embrace AI. Everything in my experience tells me AI and Machine Learning are fundamental technologies ready to spawn hundreds of disruptive applications and rip up existing business and social fabrics. The state of the technology reminds me of TC/PIP, the fundamental technology of the internet, in the late 80s. Netscape was right down the block from me in Mountain View and we could tell they were poised to tear things up.

Enough gushing. The flip side of our love affair with AI is that organizations jump into the relationship ill-prepared and results can be an expensive disappointment. There’s a good reason these technologies are prominent in the latest Gartner Hype Cycle.

I’ve helped organizations roll out new AI ventures over for the last four years and I have kept my eyes open for patterns of success. People jump into these programs not realizing that AI and ML require some specific program management methods. Below are three domains I’d watch closely if I were you.

One: Program Management Still Matters

My first piece of advice is short and seems obvious, but it’s damned important and often overlooked. Working with breathtaking new technology does not exempt you from basic program management hygiene. Review your notes from that Program Management Bootcamp your boss forced you into, and make sure the PM basics are in place on your AI program: Does your team have a clear objective with defined division of responsibilities? Does everyone understand how to delegate? Are paths of communication clear? Get a top-notch program or product manager in place before you go crazy with that new machine learning platform you just licensed.

Two: Structuring Your AI Program

Choosing Your Internal Tech Lead: Most large companies partner with external tech providers to deliver AI-enabled ventures. That’s a fine way to go since your core competence is probably not data science, but you’ll need an internal tech lead to interact with your external partner and your internal team. I’ve noticed that the best tech leads are very good at these two activities:

- Provide a necessary level of domain expertise in data science to review proposals and manage external partners (but do not need deep, deep expertise in the field)

- Act as teacher and translator for the internal team, presenting the implications of data science in business terms

“Make sure the people reviewing proposals understand the technology behind AI.”

-Maura Sullivan, COO Fathom5 (security analytics)

Lay Down the Vocabulary: Don’t silo your tech lead. When you’re starting up, make sure everyone on your team – including your board or steering committee – understands the basic terms you’ll be throwing around. Leave the deep expertise to the experts, but get a few sentences deep on the terminology. At the bottom you’ll find my AI Glossary, and I nag on everyone to learn the terms at the outset of the project. Without the shared vocabulary your team will never communicate meaningfully.

As you define your AI program, think first about existing scenarios in your business that can be enhanced through the technology. Artificial Intelligence is best employed to augment, not replace human efforts. For example, when Citrine uses AI to hasten the development of new materials, they’re augmenting, not replacing, the critical role of a materials scientist. If you’re new to AI, my advice is to assess your existing processes and consider applying data analytics as an “overlay” to improve these processes.

On their first try with AI, I’ve seen newcomers pull off the best results when they search for low-risk, high-reward improvements in efficiency. Predictive maintenance is a classic example. Even if your maintenance model is only 90% correct you’ll see huge benefits.

“Reading glasses don’t replace our eyes. They help our eyes work better than they would naturally. In the same way, AI can help humans leverage and extend their natural cognitive ability.”

-Ken Ford, Director, Institute of Human & Machine Cognition

“Complex systems have more problems than there are people to solve them. AI can help.”

-Greg Mulholland, CEO, Citrine Informatics

Three: What’s Unique about Managing AI Programs?

Beyond the basic “program management hygiene” I mentioned earlier in point number one, what makes an AI program different from any of your other programs? I’d keep four things in mind if I were you….

Your specific challenge, not your choice of vendor, dictates the correct AI model. Don’t let vendors push you into a particular approach. It may be the only approach they offer. First of all, establish the answer to a simple question: Do you even need AI? Some deterministic challenges are served by conventional statistics rather than AI. Make sure your tech lead has the background to guide the team to the right partner.

“Trying to use the wrong analytic technique will net you the wrong answer most of the time.”

-Maura Sullivan, COO Fathom5 (security analytics)

Structure your AI program as a series of agile experiments, not a monolithic award. Don’t fall into the traditional large-enterprise trap of specifying an exhaustive program. Take a page from the Agile playbook and create a series of sprints — your AI partners will actually prefer to work this way with you, as you can see from the quotes below.

Remember that you’ll need stored data to kick off the first sprints in your program (more on this shortly). Identify disclosable small bits of data from sources you trust, or create synthetic data. Remember that sanitizing data will take time.

If possible, put your data in a separate network, and create a pilot program or hackathon rather than a program of record. Steer clear of your heavy corporate IT guidelines during your early stages of learning.

“Encourage small-budget ‘bake-offs’ to experiment with different approaches. Follow the X PRIZE model.”

-Sam Septembre, FireEye

“Rather than asking partners to submit a 100 page proposal, bring teams in to compete on real-time challenges to see how they work.”

-Angela Zutavern, Data Scientist, Booz Allen Hamilton

Next up is an area I’ve seen go wrong many times: Budget plenty of time for data engineering prior to data science. Data engineering is as much of a problem as data science, but it is often overlooked. Make sure your data engineers go through the process of collecting data, storing it, batch processing or real-time processing it, and serving it via an API to data scientists who can easily query it. Take Muddu’s quote below seriously – he’s among the most respected names in AI.

“It takes 4 data engineers for every 1 data scientist.”

-Muddu Sudhakar, AI Entrepreneur, Investor, CEO

“It’s hard to get clean data. We had to scrub the data and this stole time from analysis. It would be nice if there was one repository for data with consistent file format and cleanliness.”

-Scientist, Frontier Development Lab, NASA

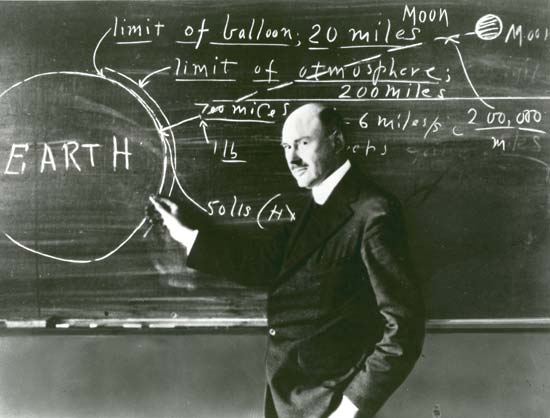

Recently I spoke to an incredibly brainy group of data scientists from NASA’s Frontier Development Lab. They had just won an award for their use of machine learning to predict harmful solar eruptions that might knock out communications, avionics, even national security. When asked what they would change next time, they asked for…yes, you guessed right…better data engineering.

Thanks for hanging with me to the end of this. One last point….

Consider long-term staffing and maintenance of your AI system. Everyone expects significant initial investment, but many data science users are dismayed by the “technical debt” of IT overhead for ongoing support. Think about how your system will grow and evolve over time and understand that costs can race up as you maintain and upgrade your system.

“Machine learning is the high-interest credit card of technical debt.”

-Peter Norvig, Director of Research, Google

“The more opaque the automation, the more manpower is needed to interface with it.”

-Ken Ford, Director, Institute of Human & Machine Cognition

(Appendix) A few definitions

If you’ve made it this far, I expect replies quibbling with my definitions, but remember the key point here: Without the shared vocabulary your stakeholders will never communicate meaningfully with the core team. So get everyone on your team a few sentences deep in vocabulary.

Data Science: the extraction of knowledge or insights from data in various forms, either structured or unstructured.

Artificial Intelligence (AI): systems that are able to perform tasks that normally require human intelligence, such as visual perception, speech recognition, decision-making, and translation between languages.

Machine Learning: a type of AI that provides computers with the ability to learn without being explicitly programmed.

Deep learning : a subset of machine learning that has networks capable of learning from data that is unstructured or unlabeled. Also known as Deep Neural Learning or Deep Neural Network.

Data Engineering : the process of collecting data, storing it, batch processing or real-time processing it, and serving it via an API to data scientists who can easily query it.

Deterministic Model: a model where the output is fully determined by the parameter values and the initial conditions.

Stochastic Model: a model that possess some inherent randomness. The same set of parameter values and initial conditions will lead to an ensemble of different outputs.

Glossary

When you’re starting up, make sure everyone on your team – including your board or steering committee – understands the basic terms you’ll be throwing around. Start with these seven, they’re not that bad….

Data Science

The extraction of knowledge or insights from data in various forms, either structured or unstructured.

Artificial Intelligence (AI)

Systems that are able to perform tasks that normally require human intelligence, such as visual perception, speech recognition, decision-making, and translation between languages.

Machine Learning

A type of AI that provides computers with the ability to learn without being explicitly programmed.

Deep learning

A subset of machine learning that has networks capable of learning from data that is unstructured or unlabeled. Also known as Deep Neural Learning or Deep Neural Network.

Data Engineering

The process of collecting data, storing it, batch processing or real-time processing it, and serving it via an API to data scientists who can easily query it.

Deterministic Model

A model where the output is fully determined by the parameter values and the initial conditions.

Stochastic Model

A model that possess some inherent randomness. The same set of parameter values and initial conditions will lead to an ensemble of different outputs.